President Barack Obama presented his deficit reduction plan today (19 September 2011) which includes a modest increase in taxes on millionaires and billionaires, closes tax loopholes for profit-heavy corporations and is supported by the likes of billionaire Warren Buffet. The speech from the Rose Garden at the White House follows on the President’s jobs plan introduced at a joint session of Congress 12 days ago and legislation sent to congress one week ago.

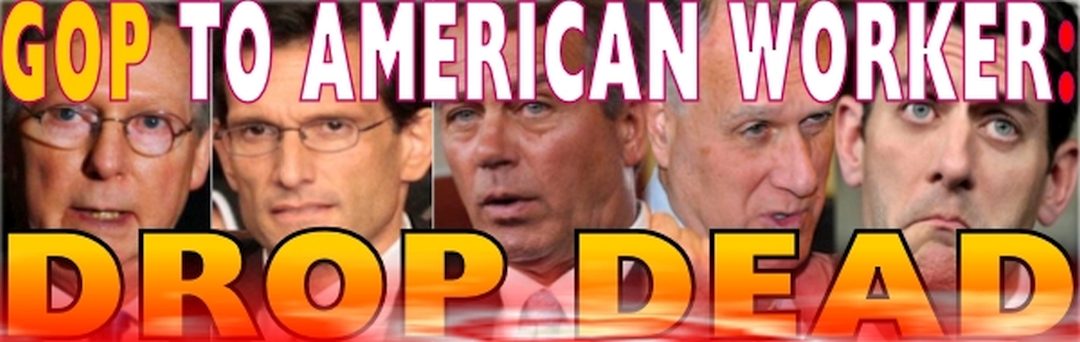

The jobs plan has already been dismissed by the GOP leadership with Speaker John Boehner (R-OH) and House Majority Leader Eric Cantor (R-VA) rejecting payroll tax cuts for middle class workers and families.

It is important to note that the President’s jobs plan includes much of what Republicans have demanded in the past and have voted for in the past; which begs the question, how far right does President Obama have to go to placate the Republicans.

Republicans and their media hacks – dredging out the tired, old meme – are calling the President’s populist deficit reduction plan ‘class warfare’. Closing loopholes for the largest corporations registering record profits and who pay no taxes and get tax rebates, according to Republicans is class warfare. But no tax breaks for workers, middle-class families and the poor is not class warfare. It is, according to Republicans, that “we don’t have enough people paying taxes in this country” .

Professor Robert Reich, economist and political analyst who served in the Ford and Carter administrations and was President Clinton’s Labor Secretary from 1993 to 1997, said “it’s not warfare to demand the rich pay their fair share of taxes to bring down America’s long-term debt”.

Professor Reich continues: “After all, the richest 1 percent of Americans now takes home more than 20 percent of total income. That’s the highest share going to the top 1 percent in almost 90 years”.

In addition, said Professor Reich, the wealthiest Americans “now pay at the lowest tax rates in half a century – half the rate they paid on ordinary income prior to 1981″.

While Republicans in Congress and media punditry shout out that ‘the American people’ don’t approve of President Obama’s jobs or deficit reduction plans, the opposite is true.

Poll after poll clearly show that the average voter supports the President’s plans. A recent CNN/ORC survey said ‘a 43 percent plurality’ support the jobs plan. A Gallup survey showed 45 percent. And a CBS/New York Times poll on Friday showed “majorities supported all components of the jobs plan”.

The other tired, old tactic Republicans like to push when attempting to scare working people , that tax hikes hurt small businesses, is disproved, quite easily, in an article at Think Progress. That claim, according to the article, simply isn’t true: “as just 3 percent of people with any business income at all, from a business large or small, would be affected if the top two tax rates increase”.

ed note: I originally put this piece together in September 2011 for a different publication.